Dr. Ayesha Rahman¹, Dr. Nikhil Deshmukh², Dr. Fatima El-Masri³, Dr. Jonathan Kim⁴

¹ Department of Financial Technology, Institute of Digital Innovation, University of Leeds, UK ([email protected]k)

² School of Computer Science and Artificial Intelligence, Indian Institute of Technology (IIT) Bombay, India

³ Department of Economics and Blockchain Studies, American University of Beirut, Lebanon

⁴ Department of Finance and Data Analytics, University of British Columbia, Vancouver, Canada

Abstract

The landscape of financial services has been reshaped by rapid advancements in financial technology (fintech). Today’s banks operate in fundamentally different ways than in the past, leveraging mobile banking platforms, digital wallets, and blockchain systems to broaden financial inclusion—especially among those previously excluded from traditional banking. A key driver of this transformation is artificial intelligence (AI), which enables real-time data processing, customized financial insights, and advanced predictive analytics. One of the most prominent outcomes has been the rise of robo-advisors: AI-powered, algorithm-driven platforms providing automated investment and financial planning solutions. Initially built on foundations like Modern Portfolio Theory, robo-advisors have evolved into complex systems that incorporate machine learning, neural networks, and reinforcement learning. Once viewed as niche tools for retail investors, these platforms are now integral to the strategies of major financial institutions. This study traces the growth of robo-advisors from their inception following the 2008 financial crisis to their current status as mainstream tools. It explores how personal finance has become increasingly intertwined with AI innovations such as Natural Language Processing (NLP) for virtual assistants, deep learning for sentiment analysis, and Explainable AI (XAI) for transparency. Emerging technologies like generative AI for financial advisory, quantum computing for portfolio optimization, and smart contracts via blockchain are further shaping the field. Despite these advancements, challenges persist around data privacy, algorithmic fairness, and regulatory oversight. Looking ahead, the future of robo-advisors will depend on their ability to integrate cutting-edge innovations while addressing ethical concerns and building user trust—ultimately contributing to a faster, more transparent, and secure financial ecosystem.

Keywords: Financial Technology (Fintech), Artificial Intelligence (AI), Robo-Advisors, Generative AI, Quantum Computing, Blockchain Technology, Investment Management, Personalization, Explainable AI (XAI), Machine Learning, Natural Language Processing (NLP), Financial Inclusion, Portfolio Optimization, Algorithmic Bias

© The Author(s) 2025. Open Access This article is licensed under a Creative Commons Attribution-NonCommercial–NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third-party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit https://creativecommons.org/licenses/by-nc-nd/4.0/

1. Introduction

Advancements in economic technology are reshaping the financial services industry. Traditional client interactions are rapidly being replaced by flexible digital channels designed to meet the evolving needs and preferences of consumers. Tools such as mobile banking applications and digital wallets have streamlined financial management, while blockchain technology provides enhanced security and authentication for business transactions. As a result, dependence on legacy systems is steadily diminishing. Cryptocurrencies, built on blockchain — a decentralized digital ledger that operates without central authority — exemplify this shift (Du et al., 2024).

AI as a Transformational Force in Finance — Artificial Intelligence (AI) has emerged as a transformative force in the financial sector, just as it has in fields such as healthcare and education. AI-powered systems are now capable of processing enormous volumes of data to detect market trends and deliver rapid, personalized financial advice. Among the most impactful innovations in this space is the rise of robo-advisors (Arenas-Parra et al., 2024). These AI-driven platforms provide personalized financial guidance and automated investment management at significantly lower costs than traditional human advisors. Robo-advisors have democratized access to financial planning, particularly for millennials and individuals with smaller portfolios, offering the same fundamental services once exclusive to high-net-worth clients (Barile et al., 2024). However, this progress is accompanied by critical challenges — including data privacy concerns, potential algorithmic bias in financial predictions, and the complexity of accurately modeling consumer behavior. These issues underscore the importance of examining the nuanced discourse surrounding generative AI in financial contexts. Striking a balance between innovation and consumer protection is imperative. This article explores the origins and evolution of AI-powered robo-advisors, delves into their technical limitations, and evaluates their growing influence across the financial landscape. The broader role of information technology in driving employment and transformation across various sectors — including manufacturing and cement industries — has also been noted (Abbas et al., 2018), further emphasizing the wide-reaching impact of technological advancement on the economy.

The Evolution of Robo-Advisors

1. Early Foundations (2008–2010): In the Wake of the Financial Crisis

Robo-advisors emerged in the aftermath of the 2008 global financial crisis, a period marked by widespread distrust of traditional financial institutions (White, 2023). In response, there was growing demand for more transparent, affordable, and accessible investment solutions. This environment paved the way for the creation of innovative digital advisory platforms. Among the pioneers in this space were Betterment, founded by Jon Stein in 2008, and Wealthfront, co-founded by Dan Carroll and Andy Rachleff that same year (Scholz & Tertilt, 2021). These early robo-advisors adopted Modern Portfolio Theory (MPT) — a framework introduced by Harry Markowitz in 1952 — as the foundation for portfolio construction (Markowitz, 1952). MPT emphasizes the optimization of risk and return by diversifying assets within an investment portfolio, a principle that continues to underpin many robo-advisory models today.

2. Growth and Market Expansion (2011–2015): Mainstream Adoption and Intensified Competition

Between 2011 and 2015, robo-advisors transitioned from niche fintech solutions to mainstream components of modern investment infrastructure (Ho & Jun, 2022). During this phase, traditional financial institutions began entering the market, recognizing the growing demand for automated advisory services. Industry giants such as Vanguard and Charles Schwab leveraged their brand reputation and resources to develop and promote their own robo-advisory offerings. Notably, Vanguard launched its Personal Advisor Services in 2015 (Viceira et al., 2018), introducing a hybrid model that combined algorithm-driven advice with human financial advisors — a format that has since been widely emulated across the industry. As market competition intensified, robo-advisory algorithms began incorporating more advanced computational methods. Techniques such as linear regression and decision trees were adopted through machine learning pipelines to more accurately assess an investor’s risk profile and deliver investment recommendations tailored to individual preferences. These algorithms were powered by programming languages like Python and MATLAB, which facilitated complex statistical computations (Chudoba et al., 2013). Meanwhile, platforms were built on scalable and reliable backend infrastructures using Java and .NET, ensuring robustness and performance at scale.

The platforms offered intelligent solutions that integrated historical data — as recent as October 2023 — to optimize investment recommendations (Aguilera Núñez, 2023). In 2015, Schwab’s Intelligent Portfolios introduced automated portfolio rebalancing and tax-loss harvesting, key features that aligned closely with investor trends toward cost-efficiency and digital convenience (Shanmuganathan, 2020). This period also marked a shift toward targeted marketing, particularly toward millennials, who valued low fees, minimal account requirements, and tech-savvy user experiences.

3. The AI Revolution (2016–2018): Integration of Advanced Algorithms

From 2016 to 2018, the robo-advisory industry experienced a transformative phase as artificial intelligence (AI) became central to the operational and strategic frameworks of many platforms (Belanche et al., 2019). Fintech firms such as Wealthsimple and SigFig began deploying AI-driven solutions to enhance client engagement, optimize portfolio performance, and scale advisory services (Imerman & Fabozzi, 2020). A critical development during this period was the implementation of Natural Language Processing (NLP) (Lopez-Martinez & Sierra, 2020). NLP enabled a more intuitive, conversational interface between users and financial systems, fostering the rise of AI-based chatbot advisors. These virtual assistants offered real-time responses to user queries, expanding access to financial advice and making interactions more human-like and efficient.

Advancements continued with the adoption of ensemble models and neural networks, which allowed robo-advisors to perform sophisticated back-end analysis on massive datasets to improve forecasting accuracy (Chung et al., 2023). Supporting technologies such as Google’s TensorFlow and scikit-learn libraries were instrumental in building these systems (Galea & Capelo, 2018). One of the most promising developments was the application of reinforcement learning, allowing robo-advisors to dynamically adapt investment strategies based on changing market conditions and evolving investor behavior. This marked the beginning of truly adaptive portfolio allocation strategies that could “learn” and improve over time. Parallel to these innovations was the introduction of algorithmic personalization, where investment strategies were fine-tuned to align with each individual investor’s financial history, goals, and risk appetite — shifting robo-advisory platforms closer to full-service financial planning systems powered by AI.

4. Deep Learning and Personalization (2019–2021): The Era of Real-Time Insights

The years from 2019 to 2021 marked a pivotal transformation in robo-advisory capabilities, driven largely by the emergence of advanced deep learning models (Tiberius et al., 2022). Robo-advisors evolved from passive, algorithmic platforms into systems capable of delivering real-time investment insights and highly tailored recommendations. During this period, companies like Moody’s and NetOwl integrated sentiment analysis tools powered by NLP, enabling the evaluation of public sentiment from news outlets and social media sources (Siyongwana, 2022). This contextual understanding supported robo-advisors in aligning their recommendations with market sentiment and even integrating Market Risk Premium (MRP) data into investment strategies (Hermansson, 2018). In terms of technical evolution, Long Short-Term Memory (LSTM) neural networks became essential for analyzing and forecasting time-series financial data (Sahoo et al., 2019), significantly improving responsiveness to market fluctuations. Meanwhile, programming languages like Julia gained popularity for their ability to process large-scale financial data efficiently (Gao et al., 2020), while React-based front-end frameworks enhanced user interfaces and improved the customer experience. This period also saw the emergence of “clickless” user interactions, enabling investors to access insights and complete transactions via natural language commands (Punzalan et al., 2024). These tools allowed robo-advisors to create hyper-personalized strategies tailored to individual financial goals, risk preferences, and market conditions.

5. Explainable AI and Hybrid Models (2022–2024): Transparency and Trust

As robo-advisors matured, a key barrier to widespread adoption emerged — trust in opaque AI systems. From 2022 to 2024, the industry responded by embracing Explainable AI (XAI) frameworks to enhance interpretability and transparency in AI-driven decisions (Tchuente et al., 2024). By providing users with clear justifications for recommendations, XAI addressed long-standing concerns about the “black box” nature of machine learning algorithms (Hassija et al., 2024). Originally introduced by DARPA in 2017 (Chamola et al., 2023), XAI gained traction in financial services by helping bridge the trust gap between AI systems and users (Abbas et al., 2023). During this time, hybrid advisory models — combining AI with human oversight — gained popularity (Gnewuch et al., 2024). Vanguard, for instance, updated its Personal Advisor Services to incorporate GPT-powered chatbots for conversational support alongside reinforcement learning for dynamic portfolio rebalancing (Gromulski & Ericson, 2024). Security and performance also advanced, with languages like Rust and Go enhancing system reliability without sacrificing scalability (Ameen et al., 2023). As these platforms gained traction, global financial regulators initiated efforts to standardize ethical protocols for AI use, seeking to prevent algorithmic bias and ensure fair access across demographics (Poszler et al., 2024).

6. Future Directions (2025 and Beyond): Generative AI, Quantum Computing, and Blockchain

Looking forward, the next evolution in robo-advisory platforms will be shaped by the convergence of generative AI, quantum computing, and blockchain technologies (Krause, 2024). Generative AI, such as GPT-4 and its successors, is expected to revolutionize financial planning by processing massive, multi-dimensional datasets — from macroeconomic indicators to behavioral trends — to produce comprehensive, real-time advisory services (Bengesi et al., 2024; Grant, 2024). Developers like OpenAI are spearheading this frontier, making dynamic and highly contextualized advice a near-term reality (Salloum et al., 2024).

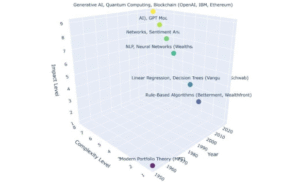

Figure 1: Timeline of key Developments in Robo-Advisors

Figure 2: Timeline of Robo-Advisors Excluding MPT

As illustrated in Figure 1, the impact and complexity of robo-advisory systems have increased in parallel with technological advancement — with Modern Portfolio Theory (MPT) at the lower end of the scale and GPT models representing the highest impact. Figure 2, which excludes MPT, further clarifies how innovation correlates directly with increases in system complexity and influence.

Quantum computing promises to dramatically enhance portfolio optimization by performing calculations and simulations previously unattainable with classical computers (Bhasin et al., 2024). Tools such as IBM Qiskit are building quantum-ready platforms capable of real-time risk modeling and investment discovery (Neway, 2024). On another front, blockchain integration — supported by technologies like Solidity for smart contract development — will bolster transaction transparency and trust through trustless execution and decentralized verification (Liu et al., 2024; Hong et al., 2023). The elimination of intermediaries in financial transactions is expected to reduce costs, increase efficiency, and promote security. To ensure safe and inclusive access to these transformative tools, sustained investment is required in infrastructure, ethical oversight, and user-centered design. These systems must evolve to become not just powerful, but also accountable, responsive, and inclusive.

Table: Evolution of Models and Technologies in Robo-Advisors

|

Year |

Key Model/Algorithm |

Contributor/Introducer |

Application |

|

1952 |

Modern Portfolio Theory (MPT) |

Harry Markowitz |

Risk-return optimization |

|

2008– 2010 |

Rule-Based Algorithms |

Betterment, Wealthfront (Jon Stein, Dan Carroll) |

Automated portfolio rebalancing |

|

2011– 2015 |

Linear Regression, Decision Trees |

Vanguard, Schwab |

Risk profiling, investment recommendations |

|

2016– 2018 |

NLP, Neural Networks, Ensemble Methods |

Wealthsimple, SigFig |

Chatbots, predictive analytics |

|

2019– 2021 |

LSTM Networks, Sentiment Analysis |

Betterment |

Real-time market trend analysis |

|

2022– 2024 |

Explainable AI (XAI), GPT Models |

DARPA, Vanguard |

Transparency, hybrid human- AI systems |

|

2025+ |

Generative AI (GPT-4+), Quantum Computing, Blockchain |

OpenAI, IBM, Ethereum |

Customization, portfolio optimization, secure transactions |

Conclusion

AI-driven robo-advisors have fundamentally reshaped the financial services landscape, democratizing access to high-quality investment advice and financial planning. From their inception in the aftermath of the 2008 financial crisis, they have evolved from basic, rule-based tools to sophisticated, intelligent systems that employ deep learning, natural language processing, and reinforcement learning to deliver personalized and efficient solutions. The coming years will usher in a new era marked by the integration of generative AI, quantum computing, and blockchain, further redefining the nature of financial services. These innovations will enable hyper-personalized strategies, real-time portfolio adjustments, and secure, decentralized financial transactions. However, these advances are not without risks. Issues such as data privacy, algorithmic fairness, and regulatory compliance remain critical. Addressing these challenges requires a balanced approach that fosters innovation while ensuring ethical use, transparency, and consumer trust. Ultimately, as robo-advisors continue to evolve, their success will depend on their affordability, accessibility, and adaptability. By addressing the financial literacy gap and offering inclusive, trustworthy financial tools, they can lead the transformation toward a more resilient, efficient, and equitable financial system.

REFERENCES

Abbas, S. K., Iftikhar, S., Waqar, N., & Waris, A. (2018). Determinants of employee engagement practices in IT sector. INTERNATIONAL JOURNAL OF SCIENTIFIC & TECHNOLOGY RESEARCH 7(5), 156-158.

- Abbas, S. K., Kő, A., & Szabó, Z. (2023). B2B Financial Sector Behavior Concerning Cognitive Chatbots. Personalized Contextual Chatbots in Financial Sector. 2023 14th IEEE International Conference on Cognitive Infocommunications (CogInfoCom),

- Aguilera Núñez, À. (2023). Design of a strategic plan for the creation of an online education and advisory platform focused on personal finance Universitat Politècnica de Catalunya].

- Ameen, N., Viglia, G., & Altinay, L. (2023). Revolutionizing services with cutting-edge technologies post major exogenous shocks. In (Vol. 43, pp. 125-133): Taylor & Francis.

- Arenas-Parra, M., Pérez, H. R., & Quiroga-Garcia, R. (2024). The emerging field of Robo Advisor: A relational analysis. Heliyon.

- Barile, D., Secundo, G., & Bussoli, C. (2024). Exploring artificial intelligence robo-advisor in banking industry: a platform model. Management Decision.

- Belanche, D., Casaló, L. V., & Flavián, C. (2019). Artificial Intelligence in FinTech: understanding robo-advisors adoption among customers. Industrial Management & Data Systems, 119(7), 1411-1430.

- Bengesi, S., El-Sayed, H., Sarker, M. K., Houkpati, Y., Irungu, J., & Oladunni, T. (2024). Advancements in Generative AI: A Comprehensive Review of GANs, GPT, Autoencoders, Diffusion Model, and Transformers. IEEe Access.

- Bhasin, N. K., Kadyan, S., Santosh, K., Ramya, H., Changala, R., & Bala, B. K. (2024). Enhancing Quantum Machine Learning Algorithms for Optimized Financial Portfolio Management. 2024 Third International Conference on Intelligent Techniques in Control, Optimization and Signal Processing (INCOS),

- Chamola, V., Hassija, V., Sulthana, A. R., Ghosh, D., Dhingra, D., & Sikdar, B. (2023). A review of trustworthy and explainable artificial intelligence (xai). IEEe Access.

- Chudoba, R., Sadílek, V., Rypl, R., & Vořechovský, M. (2013). Using Python for scientific computing: Efficient and flexible evaluation of the statistical characteristics of functions with multivariate random inputs. Computer Physics Communications, 184(2), 414-427.

- Chung, D., Jeong, P., Kwon, D., & Han, H. (2023). Technology acceptance prediction of robo-advisors by machine learning. Intelligent Systems with Applications, 18, 200197.

- Du, H., Han, Q., & de Vries, B. (2024). The effects of social influence on low-cost and high-cost household energy-efficient product adoption: a case study in Wuhan. Smart and Sustainable Built Environment.

- Galea, A., & Capelo, L. (2018). Applied Deep Learning with Python: Use scikit-learn, TensorFlow, and Keras to create intelligent systems and machine learning solutions. Packt Publishing Ltd.

- Gao, K., Mei, G., Piccialli, F., Cuomo, S., Tu, J., & Huo, Z. (2020). Julia language in machine learning: Algorithms, applications, and open issues. Computer Science Review, 37, 100254.

- Gnewuch, U., Morana, S., Hinz, O., Kellner, R., & Maedche, A. (2024). More than a bot? The impact of disclosing human involvement on customer interactions with hybrid service agents. Information Systems Research, 35(3), 936-955.

- Grant, R. M. (2024). Contemporary strategy analysis. John Wiley & Sons.

- Gromulski, E., & Ericson, J. (2024). Maneuvering the AI Frontier-An In-depth Exploration of Generative Language Models in Contemporary Management Consulting.

- Hassija, V., Chamola, V., Mahapatra, A., Singal, A., Goel, D., Huang, K., Scardapane, S., Spinelli, I., Mahmud, M., & Hussain, A. (2024). Interpreting black-box models: a review on explainable artificial intelligence. Cognitive Computation, 16(1), 45-74.

- Hermansson, C. (2018). Can self-assessed financial risk measures explain and predict bank customers’ objective financial risk? Journal of economic behavior & organization, 148, 226-240.

- Ho, K. J. M., & Jun, M. C. (2022). Robo-Advisors: A Comparative Analysis in the Context of Fiduciary Law. De Lege Ferenda, 5, 20.

- Hong, X., Pan, L., Gong, Y., & Chen, Q. (2023). Robo-advisors and investment intention: A perspective of value- based adoption. Information & management, 60(6), 103832.

- Imerman, M. B., & Fabozzi, F. J. (2020). Cashing in on innovation: a taxonomy of FinTech. Journal of Asset Management, 21(3), 167.

- Kambatla, K., Kollias, G., Kumar, V., & Grama, A. (2014). Trends in big data analytics. Journal of parallel and distributed computing, 74(7), 2561-2573.

- Krause, D. (2024). Generative AI in FinTech: Transforming Financial Activities through Advanced Technologies. FinTech: Transforming Financial Activities through Advanced Technologies (August 12, 2024).

- Liu, Y., He, J., Li, X., Chen, J., Liu, X., Peng, S., Cao, H., & Wang, Y. (2024). An overview of blockchain smart contract execution mechanism. Journal of Industrial Information Integration, 100674.

- Lopez-Martinez, R. E., & Sierra, G. (2020). Natural language processing, 2000-2019—a bibliometric study. Journal of Scientometric Research, 9(3), 310-318.

- Markowitz, H. (1952). Modern portfolio theory. Journal of Finance, 7(11), 77-91.

- Neway, A. S. (2024). Beyond the bit: A guide to quantum computing and its impact. Abegaz Sahilu Neway.

- Poszler, F., Portmann, E., & Lütge, C. (2024). Formalizing ethical principles within AI systems: experts’ opinions on why (not) and how to do it. AI and Ethics, 1-29.

- Punzalan, C., Wang, L., Bajrami, B., & Yao, X. (2024). Measurement and utilization of the proteomic reactivity by mass spectrometry. Mass Spectrometry Reviews, 43(1), 166-192.

- Sahoo, B. B., Jha, R., Singh, A., & Kumar, D. (2019). Long short-term memory (LSTM) recurrent neural network for low-flow hydrological time series forecasting. Acta Geophysica, 67(5), 1471-1481.

- Salloum, S. A., Almarzouqi, A., Gupta, B., Aburayya, A., Al Saidat, M. R., & Alfaisal, R. (2024). The Coming ChatGPT. In Artificial Intelligence in Education: The Power and Dangers of ChatGPT in the Classroom (pp. 3-9). Springer.

- Scholz, P., & Tertilt, M. (2021). Robo-advisory: The rise of the investment machines. Robo-Advisory: Investing in the Digital Age, 3-19.

- Shanmuganathan, M. (2020). Behavioural finance in an era of artificial intelligence: Longitudinal case study of robo-advisors in investment decisions. Journal of Behavioral and Experimental Finance, 27, 100297.

- Siyongwana, G. M. (2022). The enforcement of end-user security compliance using Chatbot Cape Peninsula University of Technology].

- Tchuente, D., Lonlac, J., & Kamsu-Foguem, B. (2024). A methodological and theoretical framework for implementing explainable artificial intelligence (XAI) in business applications. Computers in Industry, 155, 104044.

- Tiberius, V., Gojowy, R., & Dabić, M. (2022). Forecasting the future of robo advisory: A three-stage Delphi study on economic, technological, and societal implications. Technological forecasting and social change, 182, 121824.

- Viceira, L., Nolan, P., Rogers, T., & Runco, A. (2018). Could the big technology companies of today be the financial advisers of tomorrow? MIT Sloan Management Review, 59(2), 116-122.

- White, E. (2023). What does finance democracy look like?: thinking beyond fintech and regtech. Transnational Legal Theory, 14(3), 245-269.